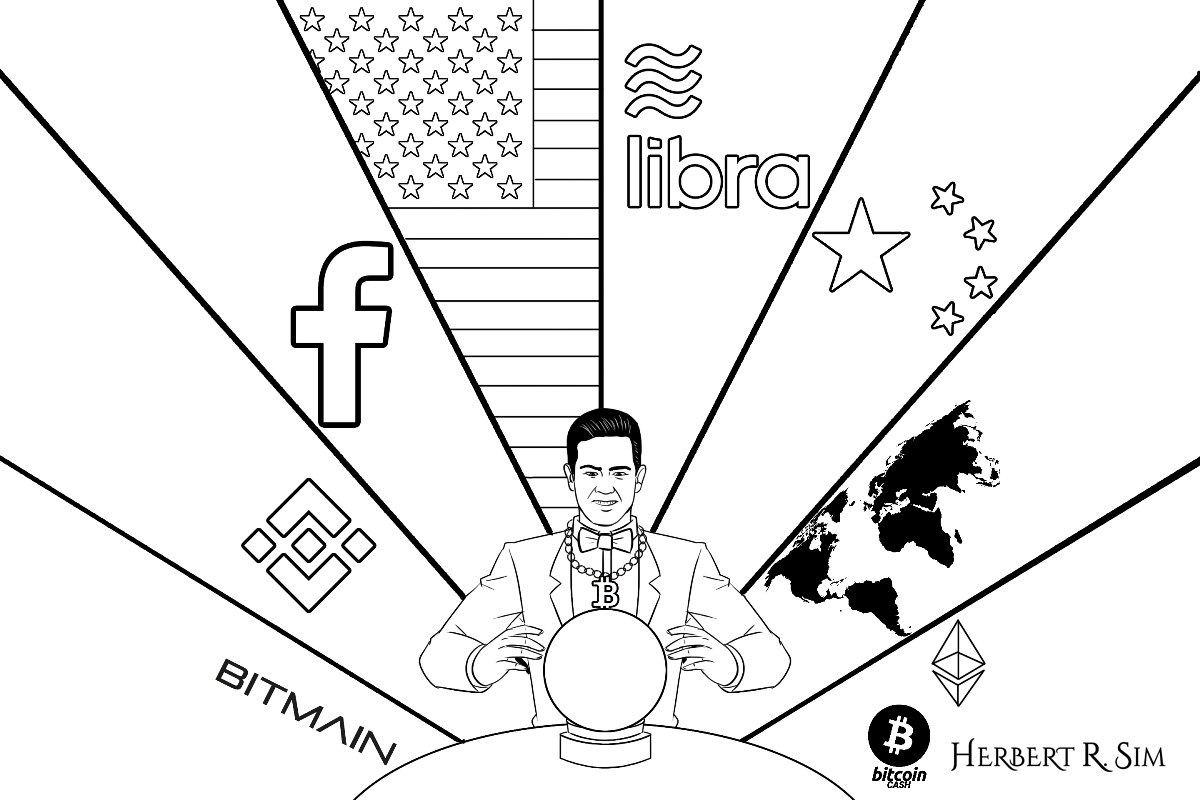

In my latest illustration, I feature myself a.k.a. ‘The Bitcoin Man’ performing a future prediction reading into the crystal ball.

———————————————————

The World Bank warns of a global debt crisis following the fastest increase in borrowing since the 1970s. In a report, the World Bank also highlights the re-escalation of global trade tensions, sharp downturns in major economies, and financial disruptions in emerging market-based and developing economies.

With uncertainty forecast in the broader global economy, what makes of the cryptocurrency sphere? Bad actors and shady token schemes flood the space, new blockchain or contract technology is overhyped or undelivered, financial markets struggle to figure out what crypto means for them, all lead to the kinds of massive spikes and dips that the market has come to be known for.

Consolidated Government Integration with Blockchain

Although governments around the world remain centralised, there are opportunities for them to incorporate decentralisation into certain aspects of their activities. There are several countries, including the US, Japan, Denmark and Estonia, that are already practising blockchain implementation in government agencies. Countries such as China and Estonia are utilising blockchain to manage citizens’ healthcare data and create digital identity systems respectively.

In 2020 we may expect other governments actually accepting blockchain advantages and begin to use it to optimise financial and public services. We will certainly see further government integration of blockchain technology in order to process large quantities of data between agencies, services and administrative bodies each having their own database.

Distributed ledgers will be crucial to streamlining interaction and information sharing between these entities. The adoption of blockchain technology for effective data management and the introduction of a distributed registry will greatly simplify this procedure and will improve the functions of government sectors.

“If you look at tax rulings overall, they haven’t been terribly against crypto […] they are being extremely progressive, with countries like Singapore, Switzerland, and Portugal making great strides for crypto.” said Alex Lindemeyer, founder of cryptocurrency tracking and tax software company, Accointing to CFO magazine. “Their policy is undefined, but the government still wants us to pay taxes. I’m just hopeful that next year we will get a lot more clear guidance, specifically on airdrops, and staking.”

China to Further Strengthen its Blockchain Adoption

In a global resurgence of diversification, national banks pique their interest in crypto, particularly when it comes to CBDCs, led by China, Turkey and France. In what is seen to be the biggest boon to bitcoin prices, China is introducing its new China Blockchain-Based Network (BSN). The alliance, pulled both from state-driven think tanks and state-owned enterprises, is designed to build trusted yet scalable infrastructure for supporting new blockchain projects and the development of a smart digital economy.

On the plus side, BSN will create a common platform upon which all the members can jointly develop, experiment and share use cases. Since the network includes banks, instant settlements could be an advantage that BSN provides to smaller companies. Other, permissioned blockchains, do have the capacity to offer a parallel benefit.

What stands is that a new digital yuan will arise, as a result of the BSN, itself born out of the government’s interlinkage with national money. Cryptocurrency is still a big no-no in the country, however by leveraging blockchain, the digital yuan has the potential to become a global currency that is used regularly, similar to the Euro and USD. Blockchain, meanwhile, represents uncharted territory; no country has a clear advantage and China is not in need of trade with another country in order to develop its software or hardware.

Above is the sketch, work-in-progress before the coloring – featuring crypto brands – BITMAIN, Binance, Facebook – LIBRA, Bitcoin Cash (BCH), Ethereum. And of course the two superpowers – USA and China.

———————————————————

Facebook’s Libra To Have A Foreseeable Impact On The Crypto Market

Lowering the cost of remittances and reducing obstacles to financial inclusion, are widely viewed as Facebook-backed cryptocurrency, Libra’s aspirations. The attention the sector has gained from Libra means that more investment will be poured into blockchain on the whole. Indeed, this is combined with the bullish behavior of Bitcoin price, which saw several price rises throughout October 2019.

Other forms of blockchain are gaining ground, with its functionality as a ledger being proven in whimsical ways such as CryptoKitties, which have had people spending over $1 million using the Ethereum blockchain they are based on.

The uniqueness is reinforced and the fact that details are safer and more secure is hammered home to those who use it, to prime them for the wider adoption of cryptocurrency further down the line. Facebook’s amplification of cryptocurrency for lawmakers and those who would use it has helped the industry hugely.

Decred co-founder Jake Yocom-Piatt notes, “Libra goes against the central ideological underpinning of cryptocurrency — it’s not decentralised. Facebook has already garnered a reputation for questionable privacy practices.” A view of mass adoption is held by Antoni Trenchev, co-founder and managing partner at Nexo, “We believe that Libra’s concept of minimal volatility will lower foreign exchange (FX) cost and facilitate even smoother cross-border trading capabilities and social inclusion. Libra will bring broad financial institutional support and will encourage mass adoption of cryptocurrencies in a variety of activities, notably in e-commerce, investments, social media interactions, the shared economy and beyond.”

2020, The Year of Global Regulation

As demand for cryptocurrency grows, global regulators are divided on how to keep up. The regulations are ever-changing and inconsistency further complicates how national banks back or authorise digital currency.

According to the Financial Times, analysts note that some central banks, such as those in Switzerland, Singapore and Canada, have looked at adopting a digital currency, while the Riksbank in Sweden, where the use of cash is rapidly declining, has an e-krona project. They think, however, that the People’s Bank of China is most likely to be first to launch a digital currency.

The key areas of regulation that lock countries in debate cover exchanges, trading and mining, crowdfunding and financial products. As the leading countries’ stances on the crypto market have changed in 2019, other regions also have a part to play in impacting cryptocurrency and blockchain adoption. Among them is the United Kingdom, according to Galyna Danilenko from Smartlands, a UK-based digital securities issuance and investment platform: “The UK has made a significant breakthrough in 2019: with the legal paper issued in November, digital assets were recognized as property.”

Jessica Renden, head of operations at cryptocurrency exchange Cointree, referred to Japan and New Zealand as the main countries that are setting trends in the crypto regulation market in 2019. Renden sums up her view to be one that is cautiously optimistic:

“The New Zealand tax authorities have confirmed that bitcoin and several other coins are approved as salary payment alternatives, subject to employment contracts set out by employers. Earlier this year the Japanese government passed a bill to incorporate cryptocurrency into regulation and to date have 21 approved registered crypto exchanges.”

Russia is another country that made the most promising breakthrough in cryptocurrency regulation, according to Evan Luthra, a tech entrepreneur and blockchain expert holding an honorary Ph.D. in decentralised and distributed systems. He says in an interview with Coin Telegraph that although legislation on cryptocurrencies has not been formed yet in Russia, a lot has changed throughout the year:

“The authorities changed their initial radically negative position and are now interested in developing new technologies for the benefit of the state, financial system, welfare, and convenience of citizens. The main achievement, I guess, was the Russian Federal Law ‘On Digital Rights’ release.”

China To Rival Silicon Valley When It Comes To Disrupting Banking

When it comes to disrupting conventional banking, no other nation-state has a firmer grasp than China. Bloomberg News argues that for China, “blockchain and the yuan digital currency are a national strategic priority — almost at the level of the internet,” says Sanford C. Bernstein & Co. fintech analyst Gautam Chhugani. The Wall Street Journal warns that cautious scepticism will still be on play when it comes to state adoption of blockchain solutions. If China is successful in its blockchain efforts, Chinese companies that become enmeshed in the state’s surveillance and regulatory architecture are increasingly coming under scrutiny from Western regulators.

As the US and China enter the headwinds of its long-drawn trade war, similarly entangled will be its battle for blockchain dominance. China’s blockchain push serves two of its strategic goals outlined by WIRED magazine. These include putting an end to the omnipresence of the American dollar and becoming less reliant on the US or foundational technologies.

What a digital currency developed by China attempts to chart is a global clout that is on par with its significant domestic blockchain development. It is the decentralised stature of blockchain that delivers notable economic and social benefits in a country like China, which typically rates low on the trust barometer. In Xi’s words, China will “take the leading position … occupy the commanding heights of innovation, and gain new industrial advantages.”

The blockchain pipeline in China looks set to generate further interest, reports Ledger Insights. Even with the regulatory hurdles and China’s dislike for cryptocurrencies, the country is seeing numerous blockchain initiatives. IDC sees trade finance as the most prominent blockchain application in the country.

A perspective of rolling out ‘blockchain with Chinese characteristics’ explains why the government can be so gung-ho with blockchain but crack down on the Chinese public’s speculation on cryptocurrencies as well as initial coin offerings. In China, curbing crypto speculation is seen as a social good. But a ban also gives government control over cryptos. With few investment options for the Chinese, and with a cap on how much money they can send abroad to invest, people get around the rules by buying bitcoin in-country and selling when they travel outside China, according to a study by the University of Pennsylvania-Wharton.

The Bitcoin gold chain was first conceptualised in 2014 in my illustration of Satoshi Nakamoto being interviewed by the media – brought to life during the launch of ‘The Bitcoin Man’ branding.

———————————————————

Decentralisation Is The Next Deep Dive

Many companies are looking for ways to close that gap and make the best of the decentralisation of public blockchain networks on one side and the additional security of private networks on the other. Tech companies such as IBM and blockchain platforms like Corda and Ripple, are already responding with enhanced offerings and will continue to build these out to meet enterprise demand.

The International Data Corporation (IDC) reports that it is time for hybrid cloud initiatives to focus on IT goals, in addition to business objectives. 2020 is expected to be the year when we will start to see growing offerings of so-called hybrid blockchains. Hybrid blockchains, are a combination of a private or permissioned blockchain and public blockchain. According to surveys, it is expected that more than 80% of future blockchain deployments will be hybrid or multi-cloud — or both. Especially networks with stringent data sovereignty and confidentiality requirements will clearly have chosen frameworks that support hybrid or multi-cloud models.

Pascal Thellmann, CEO of the CoinDiligent review and guide platform for cryptocurrency investors, believes that 2020 will see a significant rise in decentralised exchanges and dApps (decentralised apps), largely caused by regulatory pressure.

He commented: “Scandals like the recent BitMEX email leak, the Bithumb hack, and also the crackdown on cryptocurrency exchanges in Shanghai have truly remarked the value proposition of decentralised exchanges.

“Further, major exchanges are also getting increasing pressure from regulators, which is forcing them to implement KYC and stricter monitoring on its users. BitMEX, for example, is rumoured to roll out full KYC in Q1 2020.

“Hence, I think that one of the largest crypto trends of 2020 will be a major flow of liquidity from centralised OTC desks, derivatives exchanges, and spot exchanges to decentralised alternatives.”

Fabio Canesin agrees, saying: “We believe that 2020 will see a continuation of the movements started in 2017. As always, we at Nash continue to believe the killer app of blockchain is finance, the application for which it was created. Decentralised finance apps will continue to grow in number and sophistication.”

Komodo CTO Kadan Stadelmann also believes that the “rise of the DEX” will be inevitable in the face of increased hacks and centralised exchange crackdowns.

The European Securities and Markets Authority (ESMA) recently released its 2020-22 focus plan detailing how the agency will try to integrate a joint regulation of cryptocurrencies in the European Union. It’s very unlikely for ESMA to target anything technical regarding cryptocurrencies or ban any ICOs, IEOs or STOs coming to the market in the future. However, it will most likely target the way crypto trading information is handled in the European Union. Whilst the mood is one of hesitation in the European Union, the investment banking giants of the US seem to be much in favour of directing their focus towards the crypto space.

Uncertainty Propelling The Outlook For The Global Economy

In an interview with French financial newspaper Les Echos , Goldman Sachs CEO David Solomon said that they are doing extensive research on the concept of “tokenisation.”

Solomon expressed his belief in the potential of blockchain-based digital currency in enabling frictionless cross-border payments. Similar to JP Morgan, Goldman Sachs believes such a currency will need to be backed by actual fiat currencies.

According to Solomon, cryptocurrency regulations are likely to see a change in the near future. “I think regulators around the world are watching what’s going on. They wonder how it will work and are very attentive to payment flows. There will be a change in regulation, that’s for sure.”

“The digital currency war is hotting up now,” says Glen Goodman, former business correspondent with ITV and author of The Crypto Trader. “Unfortunately, as this war is all about power-grabbing, it doesn’t mean the superpowers will become more relaxed about decentralised cryptocurrencies like Bitcoin. Their plan is for controlled centralized digital currencies and they have no intention of allowing an outsider currency like Bitcoin — or even Facebook’s Libra – to dominate world trade.”

With issues over escalating trade tensions, the no-deal Brexit, military clashes and global uprisings and the challenges of cybersecurity, government support of cryptocurrency will stay conservative and cautious. However, with more economic crises happen over the next decade that weaken fiat currencies (particularly in terms of inflation), it’s reasonable to expect that crypto might rise in parallel. It wouldn’t be a convenient equation if crypto would require capitalising on catastrophes to gain wider adoption.