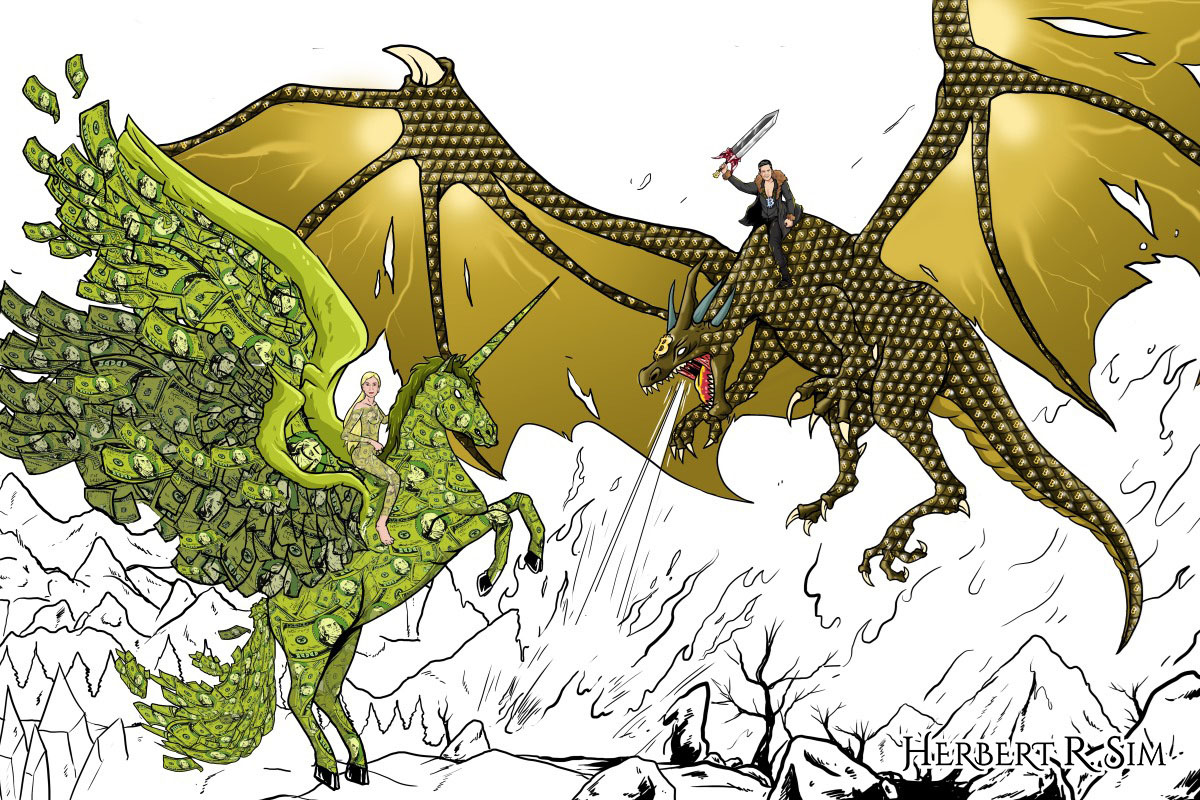

My illustration of Bitcoin versus Fiat Dollar, featuring The Bitcoin Man riding the Bitcoin Dragon, and Lady Liberty riding on the Fiat Unicorn.

————————————————————

The rich get richer and the poor get poorer.

You may have come across the above aphorism, an axiom that has never been so damning in its observation, yet equally reflective of our modern monetary world.

The current global monetary system runs on the premise that sovereign states can authorise and create currencies they can call their own. The intricacies of such include holding the right to distribute power and wealth, armed with the responsibility to keep the economy running, manage inflation and prevent it from spiraling out of control.

Mismanagement, incapability, greed and corruption are perceived to be factors that will cause a government to crumble, and this same set of factors can effect similar consequences for the national currency.

The ability of governments to print more physical money is also a tempting double-edged sword – excessive printing leads to devaluation and a serious episode could lead to an economic meltdown or a runaway inflation nightmare. Just look at Venezuela, Argentina and Zimbabwe.

For the very same reason, countries who wish to construct economic safety nets see foreign reserves as a necessity, with the US dollar occupying the largest market share in terms of being a valuable foreign holding and also its status as the world’s dominant reserve currency.

The very essence of holding the US dollar and in simple terms, keeping faith with its strength and relevance in this global money system – represents a country’s agreeableness to the US monetary system.

It is far too easy to dismiss the dollar’s longevity, or to assume that ever since the pound’s fall from grace as the world reserve currency decades ago, that the dollar too would envision the same fate.

Money Printing Habits

However, recent events may have hastened the dollar’s eventual demise, which is certainly a controversial but plausible development. Just consider the amount of new money that the Federal Reserve has printed since the pandemic struck.

To put it into perspective, the US has printed close to 80% of all US dollars in existence as of October 2021. The year before that, it was 40%.

M2 money supply, or the money in circulation that’s available to spenders in the US, was slightly over $4 trillion at the start of 2020. By October 2021, the number ballooned to $20 trillion. The number continued to grow steadily – albeit at a slower pace – clocking $21.6 trillion in June 2022.

While observers may determine that money supply has remained constant and that augurs well for the economy, the new Inflation Reduction Act of 2022 – which has just been passed by the Senate – represents another massive money printing spree of roughly $740 billion.

With what may seem like a never-ending cycle of money printing policies, coupled with the US’ debt problem and how its economy is so intertwined with that of the world’s major finance exchanges and institutions – the demise of the dollar could see far-reaching consequences that could ripple across the world.

There needs to be a solution that can dislodge the US – and the globe – from this perpetual monetary cycle and previous case studies have already given us lessons on what to avoid and guide us towards an effective answer.

The Gold Standard and Bretton Woods

In fact, the US dollar is no stranger to both challenges and challengers since 1900 when the Gold Standard Act was established, standing strong despite the demise of the gold standard when citizens could exchange gold for paper currency which turned out to be rather unsustainable.

The dollar, too, remained resolute despite the ceasing of the 1944 Bretton Woods agreement – when 44 allied nations pegged their countries to the US dollar and the US dollar, in turn, pegged its value to gold. Back then, the agreement was headlined by the fixed exchange rates system – one that signaled the official commencement of the dollar as the preferred world reserve currency.

While the new arrangement enabled the exchange of various currencies, it also meant that multiple countries were holding huge volumes of the dollar, including US Treasury securities, as they view dollar-denominated assets as being incredibly stable.

The only issue is that if these nations decide to exchange their dollar reserves for gold, it would transcend into a nightmarish scenario for the US as they might not be able to fulfil their end of the deal – to provide the desired gold that the dollar has been pegged to.

This fear materialised when America needed to fund both the long-drawn Vietnam war and its domestic Great Society programs. The solution? To print more physical money which inadvertently flooded the market.

Countries were concerned by the dollar’s uncertain direction and instability, with many wanting to convert their dollar reserves into gold – leading to several runs on the dollar. The Nixon Shock then occurred in 1971, when President Richard Nixon de-linked the dollar from gold.

Needless to say, the dollar survived the major economic policy shift and subsequent years of stagflation, apart from bringing forth ramifications that affected the global monetary system.

A massive consequence of the Nixon Shock was that it handed even more power to the central banks which we’re seeing today, with the ability to “protect” economies from severe busts of the business cycle.

While this may be perceived as a positive effect, the opposite may ring true when you consider that governments now have the leeway to manipulate variables (interest rates and money supply for example) and effect radical monetary policies such as Quantitative Easing, which we’ve seen in the printing of trillions of dollars in pandemic aid.

The Dollar is More Than Just Money

While gold has evolved into a self-regulated commodity, the dollar is pegged to crucial intangible assets – that is, the rule of law and the legal, institutionalised framework that remains a hallmark of the American government. Such traits cannot be found in alternative currencies and it magnified the concept that money is as much a legal construct as it is an economic one.

Of course, the US would find it hard to maintain its huge market share in terms of countries hogging the dollar, ceding to the likes of Australian and Canadian currencies.

However, the country has constantly evolved and adapted as the world changes as well. America continues to be the standard flag bearer for what an esteemed money system should be and how it should be run.

Being the world’s largest economy automatically grants you an international audience, a peek into controversial policies, a free pass into negative case studies to learn from as well as one of the most significant topics for debate – a money system that enables inequality – making the rich even richer and the poor, to pick up the scraps.

Despite the circumstances that have happened, the dollar continues to be held in high regard by many countries and is still considered the world’s reserve currency – but for how long?

Problems continue to persist, and the current monetary processes are perceived to only fuel inequality.

Monetary Seignorage

For a start, the current money system already puts ruling governments in an advantageous position – where they can print and create money and earn a yield on that printed money. For example, a government can print a dollar note for 10 cents, instantly earning 90 cents on that process and the revenue is called seignorage.

The revenue, while it can be determined as tax revenue to the government which in turn can help reduce the taxation on the population – can actually be leveraged in multiple ways. One of them contributes to an already widening wealth gap, where people who are already close to the beginning stages of the money supply will continue to benefit when the process repeats itself.

This sense of inequality becomes even more pronounced since those who have more will be given more – for example, the wealthy will be given lower interest rates to take out a loan – enabling even more potential for profits while lower-income individuals will find it harder or more expensive to get credit.

————————————————————

Here you can see the detailing work in progress, designing the Unicorn with Fiat Dollar.

————————————————————

Trickle-Down Theory

Other economic concepts have also made headway in widening the gap between the wealthy and the marginalised – including the trickle-down theory.

This concept postulates that benefits afforded to the wealthy will eventually trickle down to everyone else. Some of these benefits include tax breaks on businesses, high-income earners, capital gains and dividends.

Supporters of trickle-down policies determine that with an array of targeted tax cuts, the wealthy would use the additional cash to invest and drive growth, to buy stocks and even companies. Also, business owners would create new jobs and banks may ramp up their lending – contributing to heightened prosperity with benefits that will trickle down to the masses.

Critics have however taken the concept apart and pointed to its brittleness as an effective policy. Rather than having monetary perks flow down to the middle and lower income earners, trickle-down campaigns have widened the income gap instead of closing it.

Rather than spending the additional money to spur the economy, the rich might keep the additional money for themselves. A report by the International Monetary Fund (IMF) also concurred that when the lower and middle-income classes receive benefits, they will actually spend the money and spur economic growth. For example, a mere 1% increase in wealth for 20% of low-income earners would cause a 0.38% growth in the gross domestic product (GDP), whereas increasing the income of the top 20% of high-income earners would lead to a 0.08% decrease in GDP.

All Boom and No Bust

The way most of the current money systems are run, we can see how large corporations and the rich are already benefiting from it. For instance, when banks are allowed to power asset bubbles and booms through credit creation into asset markets, such actions benefit the wealthy players, banks, and financial institutions.

When a bust credit cycle happens, banks, in theory, should incur major losses – the same way they would receive huge profits during a boom cycle. However, their existence is crucial for monetary systems to work due to the need for a payment infrastructure as well as to provide credit – key aspects that help economies to function. This means a bail-out will usually happen to keep banks afloat in times of crisis which again, is another benefit for the upper echelons of society.

One other observation that highlights the discrepancy in terms of benefits for the rich, is the central bank’s perceived attempts to increase consumer inflation by lowering interest rates to incentivise banks to lend more – which in turn raises asset prices that trigger more gains for the already wealthy.

With an array of economic policies that seem to grant special favour to “the haves”, it is no surprise that the monetary system has been looked upon by some as simply a tool for the elites, who are able to consistently profit from both economic downturns and upswings.

The markets are deemed to be easily manipulated, especially so with the rich and powerful having first-hand information on market actions and data before they make a decision – a privilege that would have a profound impact on one’s balance sheet.

What then could be an ideal solution for the lower and middle class to bridge this widening inequality gap?

Enter Bitcoin… and Friends

In theory, one of the key solutions to shrink the inequality gap between the rich and poor would require a digital currency that can function like the dollar but sans authority, with a governance system (rule of law) already embedded via its software code and decentralised architecture that can serve the role of independent institutions.

While the concept of cryptocurrencies isn’t new, their existence has been fueled by a stunning bull market in 2021, forcing mainstream financial institutions and more governments to actually recognise the potential that digital currencies can bring.

In fact, some countries were early in showcasing interest in issuing a form of Central Bank Digital Currency (CBDC) – including the likes of China, Uruguay and Canada. With the UK also entering the mix lately and indicating its interest to create a seismic economic shift to its own monetary system, CBDCs are perceived to help usher in an era where digital currencies are trusted to help power a country’s economy.

Of course, one of the quickest ways to propel a new economic policy of such a disruptive nature would require a globally-recognised entity to back the system.

Enter Bitcoin, where to begin with, the accumulation of it brings forth not only economic value to the CBDC, but also underlines one’s recognition and belief in cryptocurrencies and the concept of decentralisation.

Bitcoin’s audition

To that, decentralised currencies like Bitcoin can come to the fore and offer a more flexible monetary policy that could still facilitate the commerce and capitalism that the current model isn’t capable of.

Bitcoin possesses a built-in consensus mechanism which can be seen as an extension of democratic principles – avoiding any potential clash in ideals between the decentralised asset and a ruling democratic government.

Also, Bitcoin requires zero enforcement while ensuring that there’s a rule of law and immutability as well as anonymity when transactions are made. The number of resources needed to secure the Bitcoin blockchain (proof of work methodology) is also lower if you compare it to that of maintaining the dollar – the latter requiring a legal system, government, and police force, among others.

The inflationary nature of fiat currencies, while representing a fierce cycle of production and consumption, has fanned economic expansion for many countries. However, it does not hide the fact that through such cycles, the upper class will continue to benefit from new money and the lower class being subjected to unfair economic policies.

The deflationary nature of Bitcoin also means that people will be inclined to spend less of it since there’ll only be 21 million Bitcoin in circulation – ever. To properly drive an economy, a “partner” digital currency will be needed to complement and fulfil any monetary factors that are crucial for a monetary system to work – to build off of Bitcoin’s unique strengths. When such a partnership has been determined, the future for fiat currencies, and in this case the dollar, is bleak.

Bitcoin’s mission has always been to reach out to the unbanked and straighten out the variables that central banks, for example, are trying to manipulate. With a decentralised currency in place, economic citizens would neither have to deal with varying degrees of interest rates nor contend with being judged for having too little.

A new world order

What’s crucial however is that Bitcoin’s potential as a game-changing piece of the economic puzzle is there for all to see. When nations were clamoring for an ideal asset to hedge against disastrous economic scenarios, the US stepped up with its dollar and positioned it as the best possible form of reserve currency.

However, if countries were to understand how Bitcoin can displace the dollar and become a far better version of what a global reserve should be, especially when CBDCs could enable quicker and smoother transactions in the buying and selling of Bitcoin – then what’s left for the dollar to persist with its current smokescreen as an infallible asset that all should possess?

In fact, who would have predicted that the American gold rush in the late 1840s would see a similar scenario playing out in the future, when governments acknowledge the power of Bitcoin.

A Bitcoin rush could occur when governments seek to accumulate and empower their respective CBDCs, when large corporations and the wealthy turn to Bitcoin to hedge against a failing monetary system and to a certain extent, a flawed dollar with limitations.

Also, when middle- and lower-income earners begin to understand what owning Bitcoin means, the Bitcoin rush could scale into a full-fledged tussle for the 21 million coins that will ever be mined, of which 19.1 million are already in circulation.

————————————————————

Above is the final illustration, showcasing the epic battle of Bitcoin Vs Fiat, Bitcoin Man is wielding the legendary Blade of Bitcoin.

————————————————————

Can the US Sweep Bitcoin?

Given the US’ influence on the markets around the world, the country could kick-start a monumental monetary shift in terms of its public perspective on Bitcoin.

If the US government is quick to recognise the issue that its monetary policies have, and if both the Republicans and Democrats could see eye to eye with regards to how Bitcoin can jolt the American economy into life, then once again, the US would be first movers in carrying out an unprecedented Bitcoin accumulation exercise (even more than countries like El Salvador which has made the cryptocurrency legal tender).

This can be achieved by tapping on the mammoth reserves that the US possess, and if a scenario happens whereby the Federal Reserve buys trillions of dollars in Bitcoin, it could lead to a global acquisition rush and Bitcoin could easily usurp the dollar as the preferred global reserve currency.

When that happens, correction phases will definitely occur but the road to a million dollars per Bitcoin won’t seem so farfetched anymore. Hypothetically, majority of holders will take profits when Bitcoin climbs towards the $250,000 mark, allowing for even more Bitcoin to flow into the US reserves as people sell and Washington snaps them up.

As other countries begin to acquire Bitcoin as well, individual governments will feel a lesser need to print money whenever economic challenges surface. They could turn to Bitcoin and keep respective money supplies at a consistent level, preventing markets from being flooded with new money, lowering inflation fears, and in the US’ case – maintaining the dollar’s purchasing power.

The US will also have no qualms having the dollar cede its position as world reserve currency to Bitcoin, since it has already spent heavily on acquiring the deflationary asset and no other country can produce more of it to compete with the US.

Besides, America will continue to preserve its economic and monetary dominance within the global market, since it will probably have the largest reserve of Bitcoin as it attempts to and succeeds in wrestling control from so-called Bitcoin whales.

Bitcoin will inevitably assume the status of being the world’s reserve currency – without all the repercussions that the previous monetary system had when money could be printed at will. The whole shift in monetary and economic activity will be a major phenomenon – a full-blown economic reset.

Time to Prepare Yourself

With that, before the big reset happens, what could be the best way to prepare for Bitcoin’s resurgence? To start acquiring it, of course.

The dollar’s global reserve position would eventually become untenable, just like the other predecessors that have fallen by the wayside – be it policy or currency. Printing excessive walls of money will be a thing of the past and a legitimate monetary system that’s backed by Bitcoin can only spell a much-needed revitalization.

When that happens, we’d rather you not harbor regrets of fading Bitcoin when it was down and out… or has it ever been?

situs slot gacor

bandar togel

situs toto login

jacktoto

situs toto

slot gacor

slot gacor

jacktoto

rtp slot