According to the Survey on the Global Agenda, both Asian and European respondents ranked the rise of geostrategic competition as the second most important global trend. While the old Cold War is not making a resurgence, recent developments have led to tectonic shifts in state interaction. Geopolitics – and realpolitik – is once again taking centre stage, with potential wide-ranging consequences for the global economy, politics, and society.

Blockchain, an early-stage technology enabling the decentralized and secure storage and transfer of information, could become a powerful tool for tracking and transactions that can minimize friction, reduce corruption, increase trust and empower users. Here, we examine closely some of the pertinent trends at play that position blockchain and cryptocurrency, as the next geopolitical leveraging tool.

————————————————————-

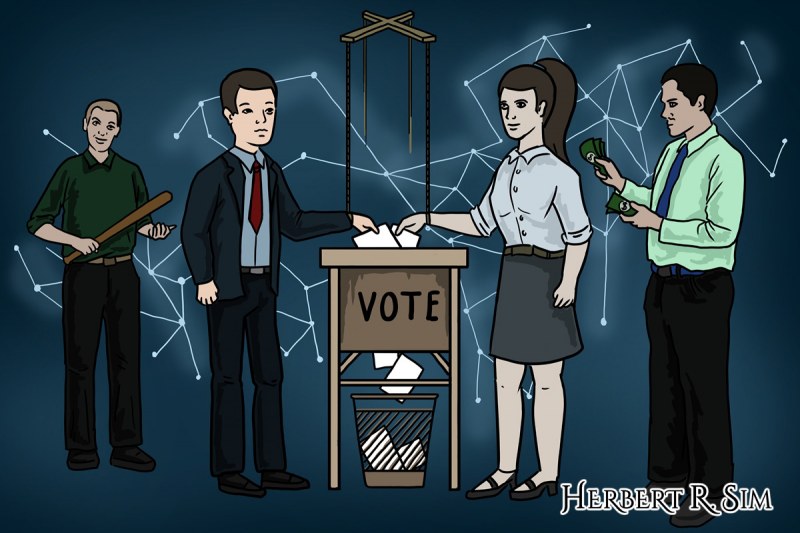

My initial sketch of political voting using blockchain technology

————————————————————-

China’s clout in cryptocurrency

Much speculation and curiosity has surrounded the People’s Bank of China (PBOC), that it is seeking to launch its own digital currency as soon as possible has caused international headlines. The PBOC cited lower operating costs, increased transparency and greater policy control over monetary supplies as incentives behind its efforts on the matter.

China has become the largest market for bitcoin users and miners as Chinese regulators have largely adopted a hands off approach to bitcoin businesses and exchanges. This has been surprising given China’s otherwise conservative controls on its financial markets. Indeed four of the five largest exchanges (based on trade volume) in 2016 are based in China: Huobi, OkCoin, BTCC, and lakeBTC. The yuan is also the most traded currency on bitcoin exchanges, with Huobi’s 30 day yuan-bitcoin trade volume 42 times larger than the trading volume of the largest non-yuan exchange.

It is important to note that the Chinese government is not ignoring the sector, having intervened in the past when it saw fit. Specifically, the digital currency market exploded in China in late 2013, with early adopter BTC China outpacing Japan’s MT Gox and EU based Bitstamp to become the largest exchange by November 2013. During the same time both Baidu and Alibaba accepted Bitcoin as payment for subsidiary services.

By December 2013, the Chinese government intervened, restricting activity, followed by Baidu and Alibaba dropping Bitcoin payment options. Despite this initial intervention, the digital currency market has continued to grow in China, with many successful exchanges popping up. While physical goods cannot be purchased with bitcoins, many Chinese are increasingly using digital currency to diversify investments and get around capital controls.

Consequently Beijing’s efforts to push forward on the creation of its own digital currency has several motivations.

Firstly, Beijing fears the unknown, and while it is pragmatic enough to recognize and adopt a winning trend when it sees it, it will still seek to minimize its exposure to risk. The idea of allowing an entire economic sector to be based on a cryptocurrency created by an unknown (an individual or group called Satoshi Nakamoto created Bitcoin in 2009) entity with unknown allegiances and/or access to back-end code, deeply concerns Beijing.

Secondly, Beijing has been badly stung by its initial efforts to liberalize financial markets, and as such is seeking to reign in potential bubble producing trends. While digital currency transactions do not pose a destabilizing threat to the Chinese economy, Beijing is seeking to implement its own digital currency to forestall the creation of a financial sub-sector outside the control of the central bank.

Lastly, given the high usages rates of digital retailers such as Taobao (C2C), Tmall (B2C), and Alibaba (B2B) in China, the implementation of a state sanctioned digital currency could further domesticate China’s internet ecosystem. In other words, China already has its own versions of Amazon, Ebay, Google etc. so promoting its own in-house digital currency becomes much easier when all the pillars of the e-commerce ecosystem are based in China.

The government can push companies to encourage transactions using the government’s digital currency, thus affording the government substantial control over the rapidly expanding e-commerce sector.

Japan’s jostling with cryptocurrency

Alongside China’s recent announcement of launching cryptocurrency regulations, Japan has also stated that it will be implementing new cryptocurrency regulations. These include the registration of exchanges with the Financial Services Agency, regular auditing, minimum capital requirements, and identity verification for customers.

This meteoric rise came to a crashing halt in 2014, when Mt.Gox filed for bankruptcy following the alleged theft of 750,000 customer bitcoins and an additional 100,000 firm owned bitcoins due to a security software malfunction. Since then Mt.Gox CEO Mark Karpeles, has been arrested twice for the disappearance of the aforementioned bitcoins valued at $480 million.

While the Mt.Gox scandal soured Bitcoin in the minds of the Japanese public, there is still significant interest among Japanese firms. The new regulations further cement a code of conduct for bitcoin exchanges, reducing uncertainty and risk for companies interested in joining the digital fray. Interested parties include Sumitomo Mitsui Financial Group, Fujitsu, and Mitsubishi UFJ Financial Corporation.

Japanese financial firms are seeking new markets, and are viewing digital currency markets as a potential growth market. Currently, said corporations are limited by Japanese laws that permit banks from owning more than five percent of a venture outside of the financial sector, or more than fifteen percent in the case of bank holding companies.

Japanese entrepreneurs have noticed the void left by the collapse of Mt.Gox and have not only sought to create new exchanges, but also create their own ‘Made in Japan’ digital currencies. One of these is FujiCoin, created by an eponymous company in June 2014.

South Korea takes financial services by storm with digital currency

2013 was also a portentous year for digital currencies in South Korea, as in December the Bank of Korea moderated its hitherto negative stance, musing on their eventual usage by the general public. While not a seemingly big announcement, it marked a shift in the Korean cryptocurrency landscape. During the same period, Korean bakery chain Paris Baguettes, became the first physical store to accept bitcoin payments.

Fast forward to 2016, and Kevin Lee, CEO of Bitcoin Korea highlights that “most Koreans are interested in bitcoin for investment purposes. They do not care about the central bank of Korea’s policy. The Korean government will follow the international trend of bitcoin.”

A major hurdle for digital currencies in any country is increasing awareness and usage outside the limited circle of early adopters and tech aficionados. To this end, South Korea has seen a major effort to promote digital currency use, with 7,000 regular ATMs now allowing bitcoin purchases. This is the result of a partnership between Coinplug, a Korean bitcoin exchange, and Nautilus Hyosung, the world’s fourth largest ATM hardware producer.

————————————————————-

As I go about detailing the art illustration further, you could see the angle/spin that I’ve deviating towards – showcasing the ‘dark side’ of politics and voting – bribery, possibly violence, and ‘strings attached’ manipulating the results.

————————————————————-

Online voting in Estonia shows peril and promise

Estonia is the only country to run Internet voting on a wide scale in accordance with its generally successful eGovernance practices, where citizens can access services through their eID card.

However, lately, its online voting mechanisms have come under scrutiny. Meanwhile, Norway has put an end to its online voting trials due to a number of concerns, such as votes being altered.

SafelyLocked co-founder and EFF Pioneer Award winner Harri Hursti said that paper ballots are simply more effective and reduce risks as compared to Internet voting, which faces the problem of not being able to have a secret ballot that’s auditable at the same time.

“We don’t know how to do that,” Hursti tells Tech.eu. “We do not have fundamental mathematical knowledge on how to do this.”

Joseph Kiniry, a Principal Investigator at US R&D firm for government clients Galois, has been critical of Estonia’s Internet voting, saying there has been little transparency in the system. Speaking to Tech.eu, he argues that, if a well-meaning hacker activist even tried to attack the system to prove its flaws, they would face serious legal consequences.

Additionally, he conducted an audit of the code within 48 hours of the release and found “numerous problems” with it, which he presented at a VoteID conference in the UK last year.

When election day rolls around in Estonia, many citizens do not need to leave their home. They merely login to their public services platform using their electronic signature and ID card and cast their ballot.

Estonia is the only country to do so on a national basis. According to the government, between 20% and 25% of voters use this online system in parliamentary and municipal elections, but the rest of Europe remains largely unconvinced.

Following Kiniry’s audit of the code, Hursti and a team of independent researchers from the University of Michigan and Open Rights Group conducted an investigation into the security infrastructure behind Estonia’s Internet voting system, which they deemed unsafe and advised on its immediate withdrawal.

Greece gives voting an upgrade through encrypted e-voting

2,500 years after they first designed democracy’s core operating system of one person one vote, the Greeks are giving it an upgrade.

A team of researchers in Athens say they’ve designed the world’s first encrypted e-voting system where voters can verify that votes cast actually go to the intended candidate.

The process happens on a distributed, publicly-available ledger, much like the blockchain — the peer-reviewed software architecture that underpins bitcoin.

The digital ballot box, called DEMOS, decreases the probability of election fraud as more voters use the system to verify their votes.

The voting system starts by generating a series of randomized numbers. Each voter gets two sets of numbers, or ‘keys’: a key corresponding to the voter, and a key that corresponds to the voter’s preferred candidate.

This is akin to the blockchain’s private and public key combination which authenticates bitcoin transactions.

Right after the encrypted vote is cast, that data is sent to multiple servers, which store the information until the end of the election. Election results are then published to a bulletin board, a publicly accessible repository that has all the election information, like vote tally and result.

“DEMOS e-voting requires a consistent, publicly accessible bulletin board, which can be potentially implemented using the blockchain technique of Bitcoin,” said Bingsheng Zhang, one of the developers of DEMOS.

But like the blockchain can potentially be compromised by too much concentration of computing power that runs the software, so too can a majority of computers used to run DEMOS change election results.

While e-voting has been tested for years, it has largely failed to take off due to security concerns. Last year, Norway ended its trials after voters expressed security concerns, the Norwegian government said in a statement. Other governments have been wary of implementing e-voting, fearing possible accusations of fraud; that vote secrecy wouldn’t be guaranteed or that results could be hacked and manipulated. In the Netherlands, a 2008 plan to elect officials to the country’s water management organizations was scrapped after tests showed hackers could break into the system, said Leontine Weesing-Loeber, a former legal adviser to the Dutch Electoral Council.

Aggelos Kiayias, professor of cryptography and computer security at the University of Athens, who works on DEMOS, said to the Wall Street Journal that committed hackers could potentially find ways around the system. Encrypted numbers attributed to voters and to their candidate have to be generated by a “clean” computer – one that hasn’t already been compromised by hackers. Extra security would also have to be in place to make sure the identification keys are not intercepted and manipulated when they travel from the computer to the voter and back.

Electronic currency to be a revolutionary instrument

In recent years, cryptocurrencies such as Bitcoin have become positioned to make deep changes on the world’s money transfer systems. Their application to fight political graft is immediately evident because cryptocurrency money, also referred to to as an e-coin, is fully traceable by anyone at any time.

Cryptocurrencies are, to some extent, the inverse of traditional money. Whereas traditional money is difficult or impossible to trace as it changes hands (a dollar is only object with no history, we could say), cryptocurrencies are different. Being intangible, they are only documented as a file that contains the signatures of every past owner of the supposed “dollar”, authorizing its transfer to a new owner. In contrast to a dollar, an e-coin is a history without an object.

The digital e-coin file is only a ledger of owners and timestamps. Identities are verified by an ongoing process of encryption that encrypts a new e-coin owner’s “signature” along with that of the previous owner to create a digital seal of authenticity.

In e-coin systems that use a public ledger, such as Bitcoin’s blockchain, transactions are not regarded as valid until they are reflected in the currency’s central historical log of all e-coin transactions. Because of the structure of an e-coin and the blockchain, which are made solely of a single e-coin’s transfer history, the ownership path of any e-coin can be quickly verified.

Cryptocurrencies present a major opportunity for countries plagued by endemic political graft. With every dollar and cent fully traceable as it passes from the civilian to the government world and back, government funds held in e-coins could disappear or leak out of the system. Corruption in developing countries, and potentially in all countries, could be significantly reduced or eliminated by the use of cryptocurrency for government funding.

————————————————————-

In my final illustration, I tweaked to make it more contrasting, and at the same time showcasing the ‘dark side’ to the fullest – Evil demonic hands ‘pulling the strings’ manipulating the results. With the only hope of ‘Blockchain Technology’ coming to the rescue, with Trust and Transparency.

————————————————————-

Cryptocurrency-funded governments to be a near realised reality

In this system, governments would be funded by fiat e-coins, which are legally the same as the country’s original currency, only electronic. Taxpayers, foreign aid donors, and government bond buyers, and other parties that provide funds to a government would be legally barred from transferring any money except e-coins to the government.

The government would be free of untraceable cash, and it would only hold traceable e-coins. This would work on the basis of removing legal tender from circulation when paying one’s taxes, for example, and creating e-coins legally valued the same as the destroyed cash. In other words, at the moment of payment to a government, X dollars of legal tender would be destroyed and X e-coins, with a fiat value of one dollar per e-coin, would be created in the cryptocurrency system.

The government would then allocate its budget, and when it needed to make a payment to a third party, it would print the new currency needed to fulfill the transaction. The e-coins would be retired from the system. The transactions between non-government and government accounts, and even government accounts, would be monitored by a public, networked computer system.

New laws would be needed to dictate the level of identity disclosure required to accept e-coins from the government, in order to further reduce fraud. Building a firewall like this to keep cash out of government accounts would significantly reduce the leaks from government accounts that have plagued the developing world.

Blockchain technology’s capabilities to drive global geopolitical synergy forward

Resources have always been a key driver of geopolitical relations. Some emerging technologies have potential to provoke the de-territorialisation of resources and thereby make most resources irrelevant as a source of geopolitical power. Through biosynthetic processes, for example, many resources that are considered scarce today might be produced synthetically anywhere in the world tomorrow.

Access to new blockchain technologies, along with their development and regulation, might become the new drivers of geopolitical leverage. The gap between developed and developing countries might increase; alternatively, boundaries might be completely redrawn along early adopters of blockchain technology, fast followers and those who lag behind.

These differences in outcome might depend on regulation as much as on innovative capacity. What will be the most coveted resources of tomorrow and how will they reshuffle geopolitical relations? Which technologies will be scarce and most desired and which will be universally accessible? Will speed of adoption of blockchain technology translate into power gains or put citizens at unprecedented risk?

From its potential impact on government competitiveness, curbing cybersecurity, regulatory efficiency and e-citizenship innovations in Estonia, the link between blockchain and geopolitics looks set to be an evolving and steadfast journey.